How To Save Money To Travel More (Part 1)

Guest blog by Rachel Trapani

“You’re so lucky to be able to travel.”

This is a statement I’ve heard many times, and it is absolutely true - I am lucky that I have the time and means to travel.

I am single, childless and working as an elementary school teacher! This makes it exponentially easier for me to pick up and go, especially with the summers off, but I also prioritize travel over having other luxuries in my life.

I am thrilled to share my system for saving for travel because it has changed my life, and I hope it will change yours too.

But first, a story….

I took a trip in the spring of 2018 that I could not afford. I had no travel savings at this time or much of a savings system at all, but all my friends were going to Grand Cayman, and I wanted to go too!

What could go wrong? Sun, sand, drink in my hand! Who wouldn’t want to be there?

I had planned a shorter stay than the rest of the group to cut costs, but on my last day, I gave in to the moderate peer pressure from my friends and extended my visit one more day. It was a beautiful last day, swimming with sea turtles and drinking cocktails on the beach.

Unfortunately, that euphoria didn’t last long…

The next day, I paid a hefty change fee for my ticket off the island and had to try to standby out of Miami airport on one of the busiest travel days of the year. I spent 1.5 days in and out of multiple airports, paid for one hotel stay to sleep for 4 hours between the last flight of the day and the first the next morning, and had to eventually buy a $500 ticket just to get out of there and back to work on Monday.

Total cost of that ONE extra day in paradise? Nearly $1000. And this was the trip I already couldn’t afford, remember?

This was a hard lesson to learn, and it is embarrassing to admit I was so reckless for so long, but it caused me to make drastic changes which ultimately changed my life for the better. I was determined to pay off all of my student loans and credit card debt and create a budgeting system that worked for my life and my priorities.

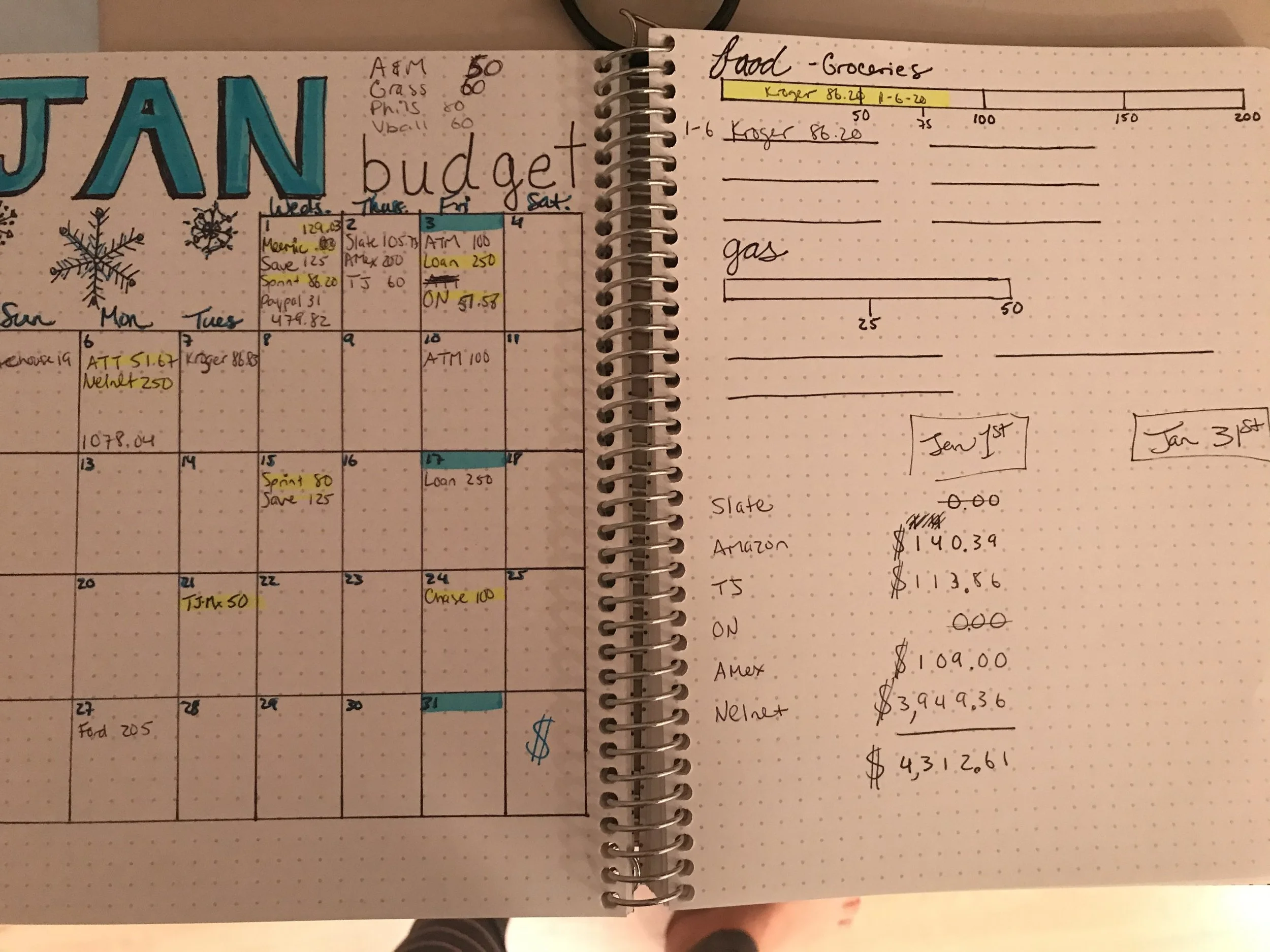

I began using a budget by paycheck system, where I would create a plan or roadmap for my paycheck before it even hit my account. Every bill and possible expense was estimated and tracked. I adopted the “pay yourself first” concept, with which I set up auto transfers for my savings accounts. At the time, the only two accounts I was depositing into were my main savings and my brand new travel savings account. Now I have 6 accounts (home, travel, taxes, pet, personal spending and gifts).

Some have asked why I have a separate travel savings account versus lumping it all into one savings account, and the reason is simple.

Having a separate travel savings account gives me a clear picture of exactly how much I have saved towards that specific goal or if I can afford a proposed trip or not.

When I started out four years ago, the auto-transfers going toward my travel savings account were small ($50-75 a check) because I was paying down debt, but now, with all of my debt gone, I send almost 15% of my take-home pay to travel savings.

I also used cash for my variable spending. This set clear limits on these expenses (grocery, nights out, gifts, and holidays), and I tracked every single dollar I spent. I took on extra jobs doing things I loved or that aligned with my job or talents like painting, cooking healthy meal prep options for friends or proctoring the SAT on a Saturday to bring in extra funds.

I shifted every dollar leftover at the end of the pay period over to my savings before the next paycheck was deposited. Being intentional about moving your money out of your checking account is crucial!

It may not feel like much when you get started, but little by little, you will make progress!

It took me a little less than two years to pay off nearly 24k in debt and one more year to buy my car in cash. Now, four years later, I’m debt free and have traveled to places like Morocco, the French Riviera, Yellowstone, Seattle, Vancouver, Mexico City, Key West, and Grand Cayman (again) without the stress of worrying how I will pay for it when I get home and the bill comes! It is the most freeing feeling in the world!

Next up, I am going to Cuba for New Years with Laura Ericson Group Trips, and I have already paid for the trip and flight in full!

Stay tuned for part two of this blog, coming soon!

Rachel Trapani is an elementary art teacher, art education professor and dog mom living and teaching in the metro Detroit area. She practices financial freedom and prioritizes travel into her life.